All Categories

Featured

Table of Contents

You can make a partial withdrawal if you need added funds. Additionally, your account value continues to be maintained and attributed with existing passion or financial investment earnings. Naturally, by taking routine or methodical withdrawals you risk of diminishing your account worth and outliving the contract's gathered funds.

In most contracts, the minimum rate of interest is evaluated concern, yet some contracts permit the minimum rate to be changed periodically. Excess interest agreements provide versatility with regard to premium settlements (solitary or adaptable). For excess interest annuities, the optimum withdrawal cost (likewise called a surrender cost) is covered at 10%.

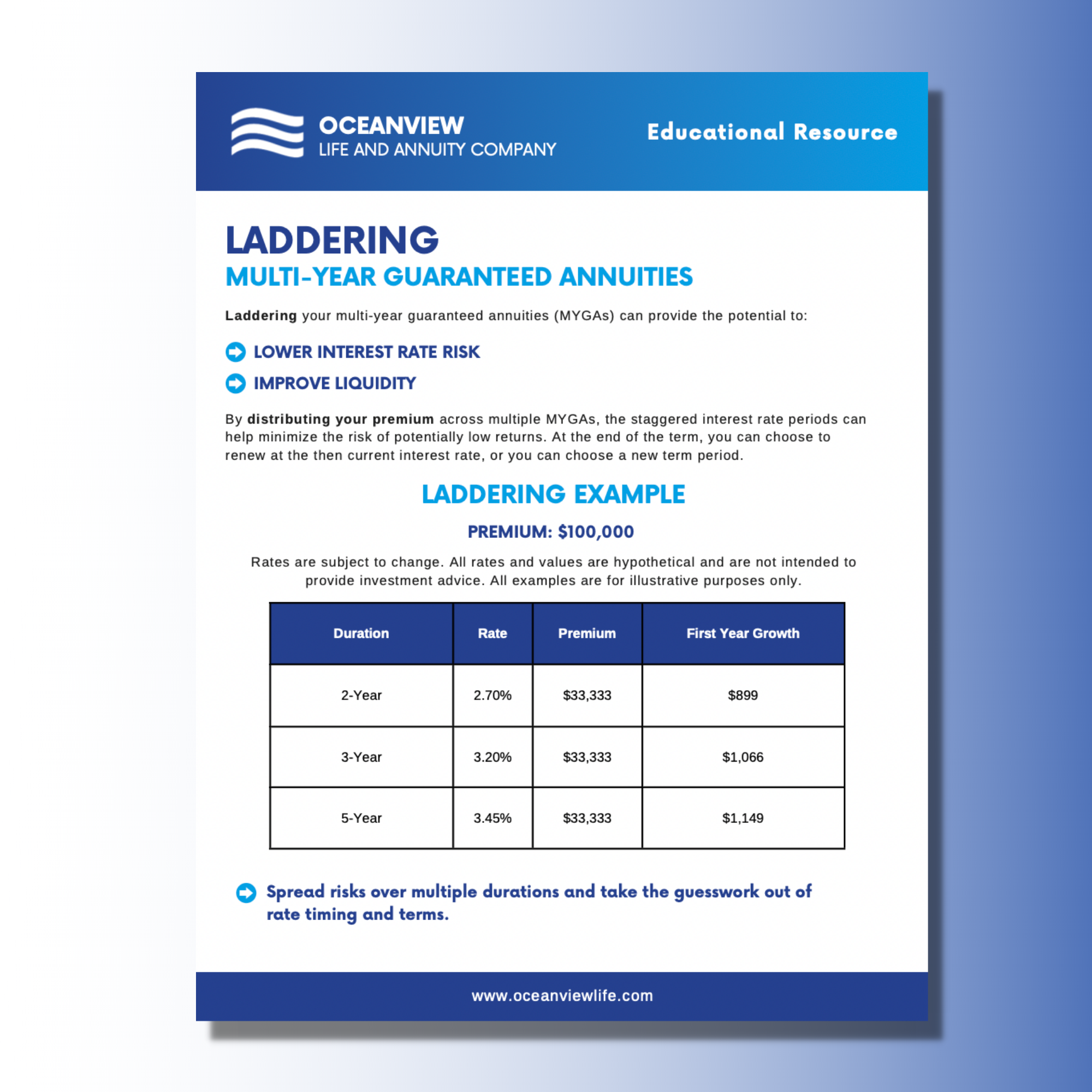

A market value adjustment adjusts a contract's account value on surrender or withdrawal to reflect modifications in rate of interest since the invoice of agreement funds and the remaining period of the rate of interest assurance. The adjustment can be favorable or adverse. For MGAs, the maximum withdrawal/surrender fees are reflected in the following table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8 and Later7%6%5%4%3%2%1%0%Like a certification of down payment, at the expiration of the warranty, the build-up amount can be renewed at the business's new MGA price.

Best Annuity Insurance Companies

Unlike excess interest annuities, the amount of excess interest to be credited is not understood until completion of the year and there are usually no partial credit reports throughout the year. Nevertheless, the technique for establishing the excess interest under an EIA is figured out beforehand. For an EIA, it is essential that you understand the indexing features made use of to establish such excess interest.

You ought to additionally recognize that the minimum flooring for an EIA differs from the minimum floor for an excess rate of interest annuity - sell annuity payments (high yield fixed annuity). In an EIA, the flooring is based upon an account worth that may credit a reduced minimum interest price and may not attribute excess rate of interest annually. Furthermore, the maximum withdrawal/surrender fees for an EIA are stated in the adhering to table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year 10Year 11 and Later10%10%10%9%8%7%6%5%4%3%0% A non-guaranteed index annuity, likewise commonly described as an organized annuity, registered index linked annuity (RILA), buffer annuity or flooring annuity, is an accumulation annuity in which the account value boosts or decreases as determined by a formula based upon an outside index, such as the S&P 500

The allocation of the quantities paid into the contract is typically elected by the owner and may be transformed by the proprietor, based on any kind of legal transfer restrictions. The adhering to are crucial attributes of and factors to consider in purchasing variable annuities: The contract holder births the financial investment risk linked with assets kept in a different account (or sub account).

Withdrawals from a variable annuity might undergo a withdrawal/surrender charge. You should know the dimension of the charge and the size of the surrender fee period. Beginning with annuities offered in 2024, the maximum withdrawal/surrender costs for variable annuities are established forth in the adhering to table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8 and Later8%8%7%6%5%4%3%0%Request a copy of the program.

Fixed Annuity Products

The majority of variable annuities consist of a death advantage equal to the better of the account worth, the costs paid or the greatest wedding anniversary account value - life annuity pension plan. Many variable annuity agreements supply guaranteed living advantages that offer an assured minimum account, income or withdrawal benefit. For variable annuities with such assured benefits, consumers need to recognize the fees for such advantage guarantees as well as any type of constraint or restriction on investments options and transfer rights

For dealt with postponed annuities, the bonus rate is added to the rates of interest declared for the initial agreement year. Know the length of time the bonus offer price will certainly be credited, the rates of interest to be attributed after such bonus offer price period and any type of extra fees attributable to such benefit, such as any higher surrender or death and cost fees, a longer abandonment charge period, or if it is a variable annuity, it might have a reward recapture cost upon death of the annuitant.

In New york city, agents are called for to provide you with comparison kinds to help you make a decision whether the substitute is in your best interest. Know the effects of substitute (brand-new surrender cost and contestability period) and be certain that the new item suits your current requirements. Watch out for changing a postponed annuity that can be annuitized with an instant annuity without contrasting the annuity payments of both, and of replacing an existing agreement exclusively to receive a benefit on an additional product.

How Much Of An Annuity Can I Buy

Income taxes on rate of interest and investment profits in postponed annuities are postponed - how to get money from annuity. In basic, a partial withdrawal or abandonment from an annuity prior to the proprietor gets to age 59 is subject to a 10% tax penalty. Special treatment needs to be absorbed roll-over circumstances to stay clear of a taxable event. Annuity products have ended up being increasingly complex.

Generally, claims under a variable annuity agreement would be satisfied out of such different account assets. See to it that the contract you choose is suitable for your situations. For example, if you purchase a tax competent annuity, minimum distributions from the agreement are called for when you reach age 73. You need to know the influence of minimal circulation withdrawals on the guarantees and benefits under the contract.

Annuities Accounting

Only purchase annuity products that fit your requirements and goals which are appropriate for your financial and household circumstances. Ensure that the representative or broker is accredited in great standing with the New york city State Department of Financial Solutions. when to get an annuity. The Department of Financial Solutions has embraced rules calling for agents and brokers to act in your benefits when making recommendations to you pertaining to the sale of life insurance policy and annuity items

Be cautious of an agent that recommends that you authorize an application outside New york city to purchase a non-New York product. Annuity items accepted up for sale in New York generally supply higher consumer defenses than items offered somewhere else. The minimal account worths are greater, costs are lower, and annuity settlements and fatality benefits are extra beneficial.

Variable Fixed Annuity

Hi there, Stan, The Annuity Male, America's annuity agent, licensed in all 50 states. The question today is a truly excellent one. Are annuities actually ensured, Stan, The Annuity Guy? You discuss contractual warranties all the time. You chat about warranties, guarantee this, warranty that. Are they truly assured, and exactly how are they guaranteed? Please tell us that Stan, The Annuity Guy.

All right, so allow's come down to the essentials. Annuities are released by life insurance firms. Life insurance business release annuities of all types. Bear in mind, there are various types of annuities. Not all annuities are poor around, you haters. You currently possess one, with Social Safety and security, you may own 2 if you have a pension plan, yet there are lots of various annuity kinds.

It's extremely, really essential for you to recognize which service provider is backing that up. Now I have a number of various methods I take a look at that when we're getting different annuity types. If we're getting a lifetime earnings stream, we're actually marrying that item, M-A-R-R-Y-I-N-G. For whatever factor, that's difficult for Southerners to state, also though I've been married 35 years, bless her heart, what a martyr.

Generally, that's going to be A, A plus, A dual plus, or better (annuities are often purchased for). I take it on a case-by-case scenario, and I stand for virtually every carrier out there, so we're pricing estimate all service providers for the highest legal assurance. Currently if you're trying to find primary defense and we're considering a certain period of time, like a Multi-Year Surefire Annuity, which is the annuity sector's variation of the CD, we're not marrying them, we're dating them

Minimum Guaranteed Interest Rate

After that period, we will either roll it to one more MYGA, send you the cash back, or send it back to the IRA where it came from. Lifetime income, marrying the firm.

As long as you're breathing, they're mosting likely to be there. Rate of interest, MYGAs, dating them. There could be a situation with MYGAS where we're getting B dual plus service providers or A minus providers for that duration since we've looked under the hood and considered it appropriate that they can back up the case.

Table of Contents

Latest Posts

Exploring Retirement Income Fixed Vs Variable Annuity A Comprehensive Guide to Fixed Indexed Annuity Vs Market-variable Annuity What Is Choosing Between Fixed Annuity And Variable Annuity? Benefits of

Analyzing Fixed Annuity Vs Variable Annuity Everything You Need to Know About Immediate Fixed Annuity Vs Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Differen

Analyzing Strategic Retirement Planning A Closer Look at Fixed Vs Variable Annuity Pros Cons Defining the Right Financial Strategy Pros and Cons of Variable Annuity Vs Fixed Annuity Why What Is A Vari

More

Latest Posts